Reliance Insurance was founded in 1981 as a public limited company and is now traded on the Pakistan Stock Exchange. The company is also registered with the Central Depository Corporation of Pakistan Ltd. (CDC) and operates in the general insurance industry.

1. 1. Introduction – Reliance Insurance Company Limited, Pakistan

Since its inception in 1981, Reliance Insurance has established itself as one of the most recognized and brilliant brands in the insurance industry, and its persistent expansion has earned it a place among Pakistan’s major insurers.

1.1. 1.1 The Sponsors

Reliance Insurance has the rare distinction of being jointly owned by two of Pakistan’s most prominent manufacturing firms. Its primary sponsors are the Al-Noor Group and the Amin Bawany Group, which are briefly described below:

1.2. 1.2 Al-Noor Group – The Founder

Mr. Ismail H. Zakaria, Chairman of Reliance Insurance and prominent entrepreneur, heads the Al-Noor Group. Apart from its stake in Reliance Insurance Company Ltd., the Al-Noor Group encompasses the following companies:

- Al-Noor Sugar Mills Limited

- Al-Noor Sugar Mills Ltd. – MDF Board Div.

- Shahmurad Sugar Mills Limited

- Shahmurad Sugar Mills Ltd. – Distillery Div

- First Al-Noor Modaraba Company Ltd.

- Noori Trading Company (Pvt.) Limited.

1.3. 1.3 Bawany Group – An Eminent Business Group

Mr. Amin Ahmed Bawany, a well-known and respected businessman, is the founder member of the Bawany Group, which includes the following firms and is considered as one of Pakistan’s most financially solid corporate industrial entities.

- Faran Sugar Mills Ltd.

- Ayesha Bawany Academy (Wakf)

- Unicol Limited

- Sind Particle Board Mills Ltd.

- B.F. Modaraba Ltd.

2. 2. Details – Reliance Insurance Company Limited, Pakistan

2.1. 2.1 Vision Statement – Reliance Insurance Company Limited, Pakistan

To be recognized as a professional and dependable business entity committed to play a meaningful role in the development of insurance industry in Pakistan and to safeguard the legitimate interests of all stakeholders, namely policy-holders, share-holders, reinsurers, employees and all other business associates/partners.

Vision Statement – Reliance Insurance Company Limited, Pakistan

2.2. 2.2 Mission Statement – Reliance Insurance Company Limited, Pakistan

To provide quality service and protection to its clients aiming at achieving a respectable volume of business and become a prominent player through good governance and sound professionalism focusing to become a well-known and respected corporate entity in the eyes of Society and Government.

Mission Statement – Reliance Insurance Company Limited, Pakistan

3. 3. Types of Insurances – Reliance Insurance Company Limited, Pakistan

Services provided by Reliance Insurance Company are divided in two main categories:

- General Insurance

- Takaful (WTO)

3.1. 3.1 General Insurance – Reliance Insurance Company Limited, Pakistan

3.1.1. 3.1.1 Fire Insurance – Reliance Insurance Company Limited, Pakistan

The Standard Fire Policy covers fire and lightning damage, with additional risks like riot, strike, atmospheric disturbance, earthquake, explosion, impact, and aircraft damage. It covers residential/commercial buildings, industries, stock, fixtures, and machinery.

3.1.1.1. 3.1.1.1 Business interruption / Loss of Profits Insurance – Reliance Insurance Company Limited, Pakistan

The above-mentioned Fire policy covers losses caused by damaged or destroyed property, but not losses generated by lower turnover and increased labor costs during the close of business or repair time and subsequently.

These losses come about because:

- Even when sales are down, some overhead expenditures will stay same. Net profit will be diminished.

- Additional expenditures may be needed to keep the firm running temporarily / at a different location.

3.1.2. 3.1.2 Marine Insurance – Reliance Insurance Company Limited, Pakistan

Cargo is typically insured from warehouse (of departure) to warehouse (of arrival), with all hazards covered as per Institute Cargo Clauses “A.” Institute Cargo Clauses “B” and “C” are utilized for lower risk. TLO (Total Loss Only, due to total loss of the vessel/aircraft) coverage is also available.

- Marine Import Cargo Insurance

- Marine Export Cargo Insurance

- Marine Inland Transit Insurance

3.1.2.1. 3.1.2.1 Marine Hull Insurance – Reliance Insurance Company Limited, Pakistan

All sorts of ships, barges, tugs, dredgers, fishing trawlers, yachts, pleasure boats, speed boats, and so on, as well as journeys for ship breaking by its own power or under tow, can be insured against maritime risks.

3.1.3. 3.1.3 Motor Insurance – Reliance Insurance Company Limited, Pakistan

Under the Motor Vehicle Act 1939, the minimum requirement is legal liability to pay damages for bodily injury or death caused to third parties. Policies include Act Liability Only, Third Party Only, and Comprehensive, providing coverage for death, personal injury, property damage, and vehicle theft.

These forms of cover apply to the main classes of motor insurance which are:

- Private cars: From the smallest to the largest.

- Commercial vehicles: From vans to articulated lorries

- Motor cycles: From mopeds to multi-c.c., multi cylinder models

- Motor trade: Garages etc. who have special needs

- Special types: Bulldozers, mobile cranes etc.

- Fleets: Groups of vehicles of any kind, provided more than, say, 10 in number and belonging to one insured.

3.1.4. 3.1.4 Miscellaneous Insurance – Reliance Insurance Company Limited, Pakistan

| Workman Compensation / Employer’s Liabilities Insurance | Basic personal accident insurance provides compensation for death or injury caused by an accident. It includes capital sums, weekly benefits, and annuities for permanent total disablement. Companies and organizations can arrange coverage on behalf of employees. |

| Money Insurance | Loss of money is the final form of risk cover, providing compensation for theft from business premises, home, or bank, and compensating employees injured or damaged. |

| Burglary Insurance | Burglary policies provide compensation for property loss or damage, similar to fire policies, but with a detailed definition of stock, force, and violence. They include a fidelity guarantee. |

| Fidelity Guarantee | The goal of this type of company is to defend against damage caused by the dishonesty of people in positions of trust, which results in direct financial loss. |

| House Hold Insurance | This coverage covers products such as jewelry and cash/prize bonds against burglary/dacoity and material damage. |

| Baggage Insurance | The extent of its insurance is global, and it covers loss or damage to the traveler’s baggage anywhere in the globe. |

| Third Party Liability | This policy indemnifies the insured for death, injury, property damage, and defects caused by the insured during the policy period. |

| Product Liability | Product Liability Policy compensates manufacturers and suppliers for defective goods, resulting in property damage or bodily injury, indemnifying them for legal liability and expenses. |

| Professional Indemnity Policy | Professional Indemnity Policy covers negligence, errors, and legal expenses for professionals like lawyers, accountants, engineers, consultants, and doctors. |

3.1.5. 3.1.5 Engineering Insurance – Reliance Insurance Company Limited, Pakistan

| Contractor’s All Risk Policy (CAR) | CAR insurance offers comprehensive protection against contract works, injuries, property damage, and liability. |

| Erection All Risk Insurance (EAR) | Engineering insurance provides comprehensive All Risk protection for machinery, plant, and steel structures, including third party liability. |

| Marine-cum-Erection Insurance including storage | Erection insurance coverage begins after marine insurance ends, offering uninterrupted coverage. |

| Machinery Breakdown Insurance | Machinery breaks down after erection, providing protection against unforeseen physical loss or damage, necessitating repair or replacement. |

| Loss of Profits following Machinery Breakdown | Consequential loss insurance covers losses resulting from machinery breakdown, including property damage. |

| Contractors Plant and Equipment Insurance | Contractor’s insurance covers physical loss or damage to plant and equipment from various sources. |

| Boiler & Pressure Vessel Explosion Insurance | Boiler Explosion Insurance Policy covers damage to boilers, pressure vessels, and surrounding property, including legal liability and injuries. |

| Low Voltage/Computer Insurance | Electronic data processing growth necessitates computer-specific insurance, offering coverage for machinery breakdown, fire, and external damage, excluding internal breakdowns. |

| Deterioration of Stock Insurance | Deterioration of Stock Policy covers loss due to mechanical or electrical breakdown. |

3.1.6. 3.1.6 Bond Guarantee Insurance – Reliance Insurance Company Limited, Pakistan

| Bid / Tender Bond | Contractors can submit tenders with earnest money or cash through Insurance Guarantee. |

| Mobilization Bond/Advance Payment Bond | MB/APB The bond protects the principal against the money he advances to the Contractor for contract job mobilization. |

| Performance Bond | A performance bond issued on behalf of the contractor guarantees the completion and performance of contract work to the principal in accordance with the contract. |

| Customs & Excise Bond | Customs & Excise release imported goods without prior payment, allowing importer time. |

| Supply Bond | A bond of this type is issued in favor of the principal as security for the contractor’s performance in relation to the delivery of the subject material. |

| Retention Money Bond | This bond is issued in favor of the principal on behalf of the Contractor in order for the principal to release the retention money. |

3.1.7. 3.1.7 Terrorism Insurance – Reliance Insurance Company Limited, Pakistan

Terrorism in Pakistan is driven by political rivalry, sectarian, religious, and ideological issues. The country has experienced increased incidents in recent years, and Terrorism Insurance Policy has become crucial. Terrorism is defined as acts or series of acts involving force or violence for political, religious, or ideological purposes, with the intention to influence government or put the public in fear.

3.1.8. 3.1.8 Aviation Insurance – Reliance Insurance Company Limited, Pakistan

Reliance Insurance is one of the few Pakistani insurance firms that provides aviation insurance to both commercial and private aeroplanes. Our comprehensive aviation insurance package safeguards the insured against any threats. Reliance Insurance offers the following aviation insurance services, among others:

- Aviation Hull All Risks

- Aviation Legal Liabilities

- Aviation Hull War & Allied Perils

- Loss of License of Pilots

- Aircraft’s Ferry Flight Insurance

- Crew Legal Liabilities

- Airline’s Airport Booth Insurance

3.2. 3.2 Takaful (WTO) – Reliance Insurance Company Ltd

3.2.1. 3.2.1 Fire Takaful – Reliance Insurance Company Limited, Pakistan

- The Standard Fire PMD covers damage caused by fire and lightning, as well as special or allied perils like riot and strike, malicious damage, atmospheric disturbance, earthquake, explosion, impact damage, and aircraft damage.

- The property insured typically includes residential and commercial buildings, industries, stock, fixtures, fittings, plant, and machinery.

- The PMD does not cover losses caused by reduced turnover, increased costs of working, or business interruption.

- The Loss of Profits/Business Interruption PMD covers loss of gross profit following loss or damage due to fire and special/allied perils.

3.2.2. 3.2.2 Marine Cargo Takaful- Reliance Insurance Company Limited, Pakistan

Cargo is typically insured from warehouse (of departure) to warehouse (of arrival), with all hazards covered as per Institute Cargo Clauses “A.” Institute Cargo Clauses “B” and “C” are utilized for lower risk. TLO (Total Loss Only, owing to total loss of the vessel/aircraft) coverage is also available.

- Marine Import Cargo Takaful

- Marine Export Cargo Takaful

- Marine Inland Transit Takaful

3.2.2.1. 3.2.2.1 Marine Hull Takaful – Reliance Insurance Company Limited, Pakistan

All sorts of ships, barges, tugs, dredgers, fishing trawlers, yachts, pleasure boats, speed boats, and so on, as well as journeys for ship breaking by its own power or under tow, can be insured against maritime risks.

3.2.3. 3.2.3 Motor Takaful – Reliance Insurance Company Limited, Pakistan

Under the Motor Vehicle Act 1939, minimum legal liability covers damages resulting from bodily injury or death to third parties. Policies include Act Liability Only, Third Party Only, and Comprehensive.

these forms of cover apply to the main classes of motor takaful which are:

- Private cars: From the smallest to the largest.

- Commercial vehicles: From vans to articulated lorries

- Motor cycles: From mopeds to multi-c.c., multi cylinder models

- Motor trade: Garages etc. who have special needs

- Special types: Bulldozers, mobile cranes etc.

- Fleets: Groups of vehicles of any kind, provided more than, say, 10 in number and belonging to one insured.

3.2.4. 3.2.4 Miscellaneous Takaful – Reliance Insurance Company Limited, Pakistan

| Workman Compensation / Employer’s Liabilities Takaful | Workman’s Compensation PMD provides worker protection in case of injury or death. |

| Money Takaful | PMD provides compensation for loss of money, including cash in safes, on counters, and in transit, crucial for small businesses and employees injured or damaged during robberies. |

| Burglary Takaful | Burglary policies aim to compensate insured for property loss or damage, with a detailed definition of stock, excluding buildings, and addressing force and violence. |

| Fidelity Guarantee | Business aims to protect against financial loss due to dishonesty. |

| House Hold Takaful | This PMD covers products such as jewelry and cash/prize bonds against the risks of burglary/dacoity and material damage. |

| Baggage Takaful | Its takaful coverage is global, and it covers loss or damage to a traveler’s luggage anywhere in the globe. |

| Third Party Liability | PMD indemnifies insured for death, injury, property damage, and defects caused by insured or service personnel during indemnity period. |

| Product Liability | Product Liability PMD compensates manufacturers/suppliers for defective goods, indemnifying them for legal expenses. |

| Professional Indemnity PMD | PMD covers negligence, legal expenses, and legal expenses for professionals. |

3.2.5. 3.2.5 Engineering Takaful – Reliance Insurance Company Limited, Pakistan

| Contractor’s All Risk PMD(CAR) | CAR Takaful provides comprehensive protection for construction project parties, including contract works, third-party claims, and contractor’s plant and equipment, ensuring unforeseen losses and damages. |

| Erection All Risk Takaful (EAR) | Engineering takaful provides comprehensive All Risk protection for machinery, plant, and steel structures, including third party liability. |

| Marine-cum-Erection Takaful including storage | Erection takaful cover starts after marine cover ends, offering uninterrupted coverage. |

| Machinery Breakdown Takaful | Machinery breaks down after erection, providing protection against unforeseen physical damage and requiring repair or replacement. |

| Loss of Profits following Machinery Breakdown | Consequential loss covers gross profits loss from machinery breakdown, including property damage. |

| Contractors Plant and Equipment Takaful | Contractor’s plant and equipment may suffer physical loss or damage from various sources, including fire, collisions, and theft. |

| Boiler & Pressure Vessel Explosion Takaful | Boiler Explosion PMD covers damage, property damage, and injuries from explosions or collapses, including indemnity for surrounding property. |

| Low Voltage/Computer Takaful | Electronic data processing demands tailored takaful for computers, covering machinery breakdown, fire, and external risks, excluding internal breakdowns. |

| Deterioration of Stock Takaful | Deterioration of stock PMD occurs due to mechanical or electrical breakdown. |

3.2.6. 3.2.6 Terrorism Takaful – Reliance Insurance Company Limited, Pakistan

Terrorism in Pakistan involves fear and violence to spread civil unrest and social paranoia, driven by political rivalry, sectarian, religious, and ideological issues. Terrorism Takaful PMD refers to acts involving force or violence for political, religious, or ideological purposes.

4. 4. Required Documents – Reliance Insurance Company Limited, Pakistan

4.1. 1. For Motor Claim – Reliance Insurance Company Limited, Pakistan

- Policy number

- Your contact numbers

- Name of insured person

- Date & time of accident

- Vehicle number

- Make and model of the vehicle

- Location of loss

- Extent of loss

- Brief description of how the accident took place

- Garage name (with contact details)

- Contact details and name of the insured person (if the person intimating the claim is not insured)

4.2. 2. Accident Damages – Reliance Insurance Company Limited, Pakistan

- Proof of Insurance – Policy / Cover Note copy

- Copy of Registration Book, Tax Receipt (Original required for verification)

- Copy of Motor Driving License (with original) of the person driving the vehicle at the material time

- Police Panchanama / FIR (In case of third-party property damage/ death / body injury)

- Estimate for repairer, where the vehicle is to be repaired

- Repair bills and payment receipts after the job is completed

In the case that the car insurance claim is to be paid to repairer submit the following along with the documents mentioned above:

- Claims Discharge Cum Satisfaction Voucher signed across a Revenue stamp in this format.

4.3. 3. Theft Cases – Reliance Insurance Company Limited, Pakistan

- Original Certificate/Policy Document

- Original Registration Book, with Theft endorsement from concerned RTO, and tax payment receipt

- Previous Insurance Details :

- Policy number

- Insuring office / company

- Period of insurance

- All the sets of keys/service booklets/Warranty card

- Police Panchanama / FIR and final investigation report/JMFC report

- Acknowledged copy of letter address to RTO intimating theft and making vehicle “NON-USE”

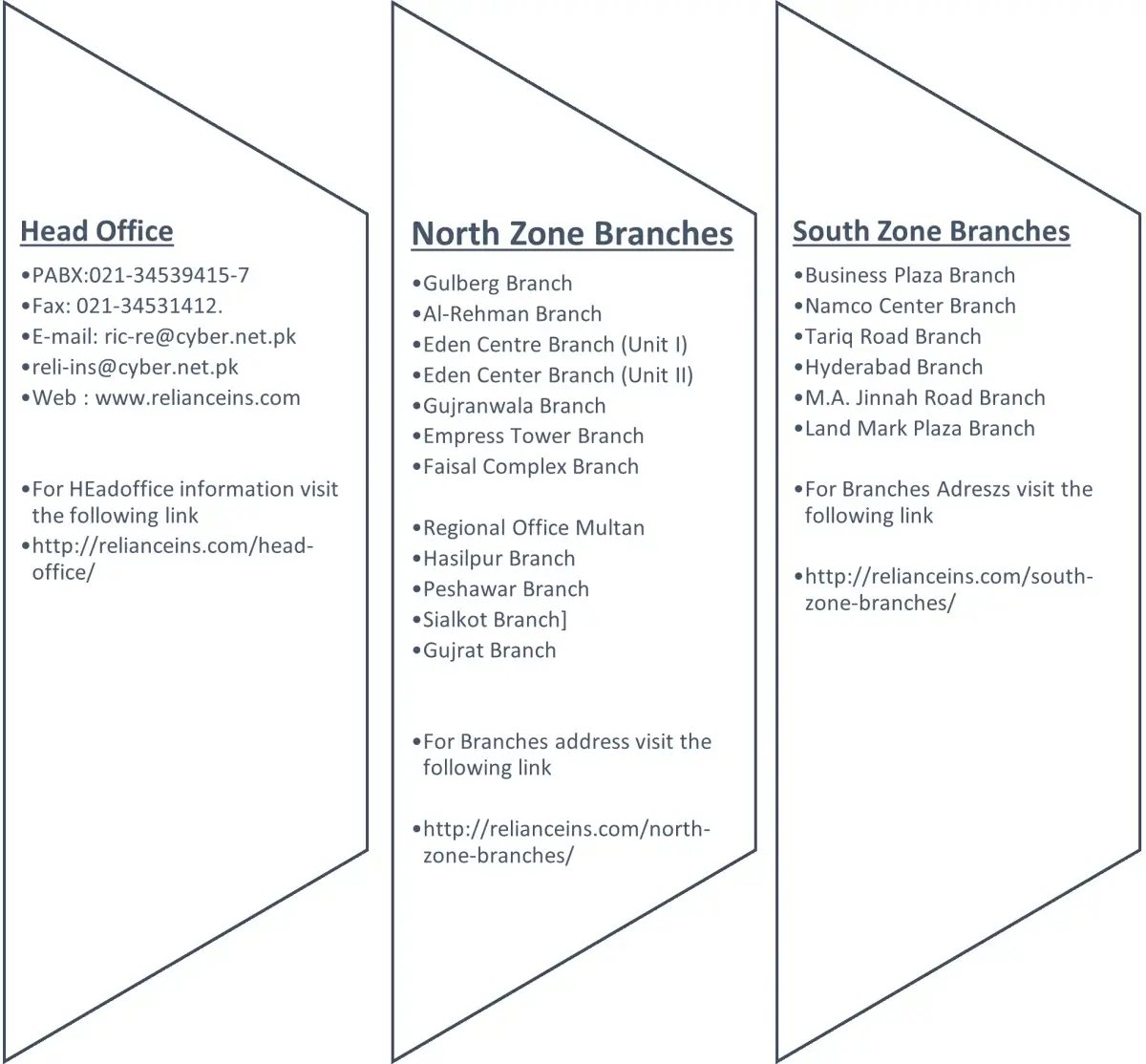

5. 5. Branches – Reliance Insurance Company Limited, Pakistan

Following are the main branches located all over Pakistan.

6. 6. Board of Directors – Reliance Insurance Company Limited, Pakistan

Reliance Insurance Company Board of Directors are,

| Chairman | Irfan Zakaria Bawany |

| Director | Mohammad Omer Bawany |

| Director | Zia Zakaria |

| Director | Noor M. Zakaria |

| Director | Ahmed Ali Bawany (CERTIFIED BY PICG) |

| Director | Muhammad Patel |

| Director | Naeem Ahmed Shafi |

| Director | Ms. Tasneem Yusuf |

| Director | Jahangir Adam |

7. 7. Clients – Reliance Insurance Company Limited, Pakistan

The following are some of the banks and companies affiliated with Reliance Insurance:

- Anam Fabrics (PVT) LTD.

- HBL Bank

- MCB Bank

- Allied Bank

- Bank Alfalah

- Standard Chartered

- MCB Islamic Bank

- Meezan Bank

- JS Bank

- Dubai Islamic Bank

8. 8. Online Helpline – Reliance Insurance Company Limited, Pakistan

- Phone Number: 92-21-3-4539415-17

- Fax: 21-34539412

- Email Address: ric-re@cyber.net.pk | reli-ins@cyber.net.pk | info@relianceins.com

- Address: 181-A, Sindhi Muslim Co-operative Housing Society, Karachi – Pakistan

- Claims: http://relianceins.com/claim-forms/

9. 1. Verification – Reliance Insurance Company Limited, Pakistan

Company is verified from,

https://jamapunji.pk/verify/licensed-entity-detail/reliance-insurance-company-limited

10. 2. Disclaimer – Reliance Insurance Company Limited, Pakistan

- If the Reliance Insurance Company Ltd have not resolved your concern satisfactorily, you may file a complaint with the Securities and Exchange Commission of Pakistan (SECP).

- Please keep in mind that SECP will only consider complaints that were initially asked to be resolved directly by the firm and were not resolved.

- Furthermore, complaints that are not related to the SECP’s regulatory domain/competence will not be considered.

If you liked this article, then please do share it on the Social Media. If you have a question or suggestion? Then you may leave a comment below to start the discussion.